Equity Transaction Model – support for companies in the investor acquisition process.

For many companies, there comes a time when further growth requires raising external capital. This may be a financial investor, a VC fund, or an industry partner who brings not only capital but also know-how, business relationships, or technologies.

To execute a professional investment process, it is necessary to prepare:

- Financial model – showing investment efficiency, valuation, profit projections, cash flow, and return on capital (IRR).

- Business plan and financial forecasts – specifying the use of capital and expected outcomes.

- Investment proposal – including the proposed share price, transaction structure, and possible investor exit scenarios.

As part of my support as Interim CFO, I prepare comprehensive equity transaction models that:

- Reflect all possible investor entry variants (new share issue, share buy-back, capital increase, contribution in kind),

- Account for changes in ownership structure (cap table) at every stage of investment,

- Show the impact of earn-outs, conditional issues, and new valuations on share value,

- Anticipate tax effects, cash flows, and interest protection mechanisms for both parties.

A sample model enables:

- Analysis of changes in cap table over time,

- Comparison of partner share values before and after investment – assuming a given valuation,

- Precise calculation of dilution and its impact on share value,

- Simulation of the effects of conditional issues, earn-outs, contributions in kind, and achievement-based bonuses,

- Preparation of coherent data for investment terms negotiation and investor presentations.

The model is not designed for company valuation, but it is an invaluable tool for discussions on how valuation affects shares and the interests of all parties.

The following model concerns a limited liability company (sp. z o.o.) with at least two partners and includes various investor scenarios:

- Scenario 1 – buyout of shares from one partner

- Scenario 2 – new share issue and capital increase

- Scenario 3 – earn-out mechanism and KPI achievement bonus

- Scenario 4 – analysis of share value at each stage of the transaction

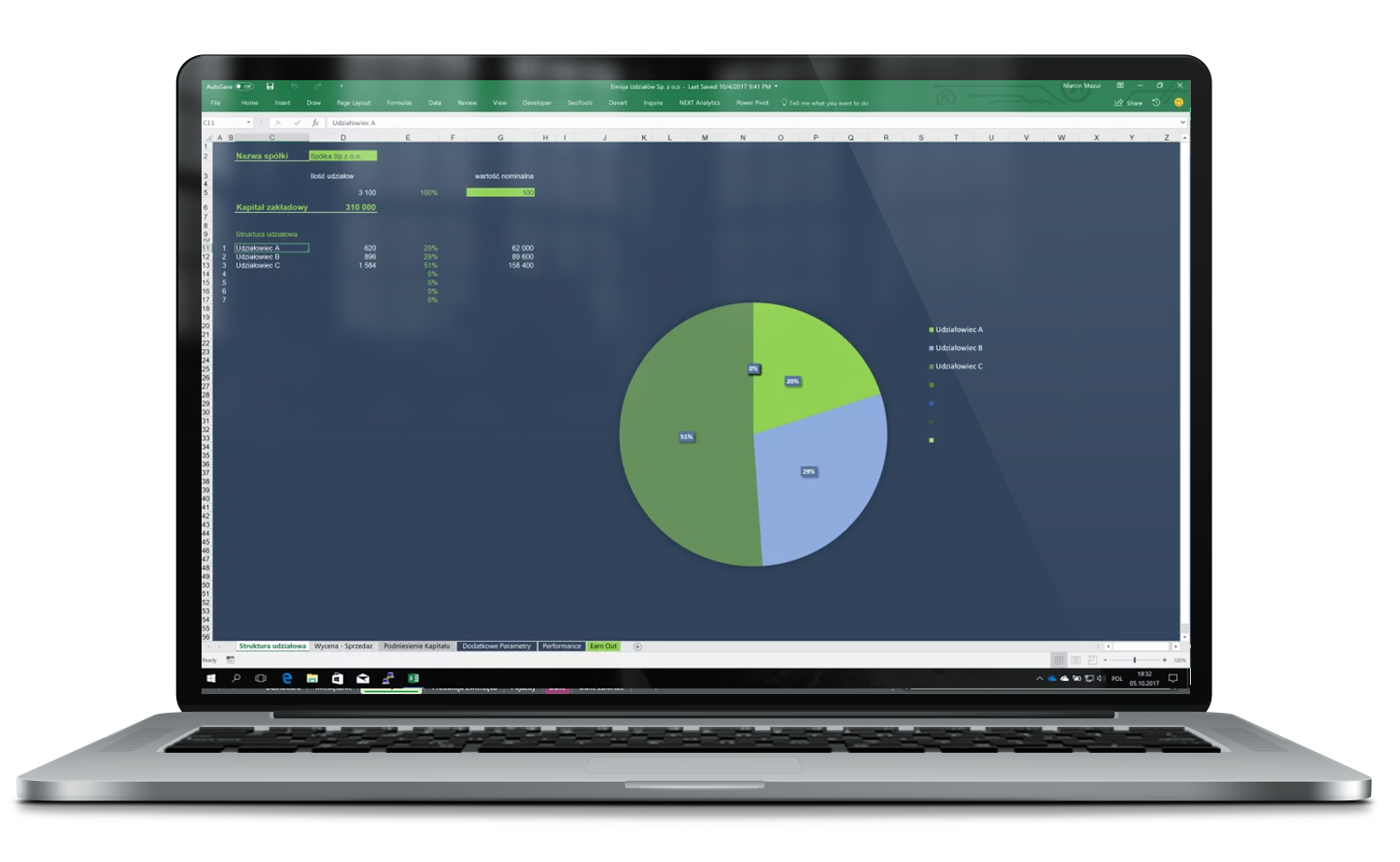

Investor entry as a new partner

The investor enters the company by taking shares from existing partners, which means a change in ownership proportions, but without affecting the share capital or the company’s cash position.

The charts show:

- A new shareholder (e.g., Shareholder A) receives 20% of the shares.

- The remaining partners (B and C) have reduced holdings (e.g., from 29% to 23%, from 51% to 41%).

- The company’s capital does not change, but the ownership structure does – crucial for analyzing the impact on voting and ownership decisions.

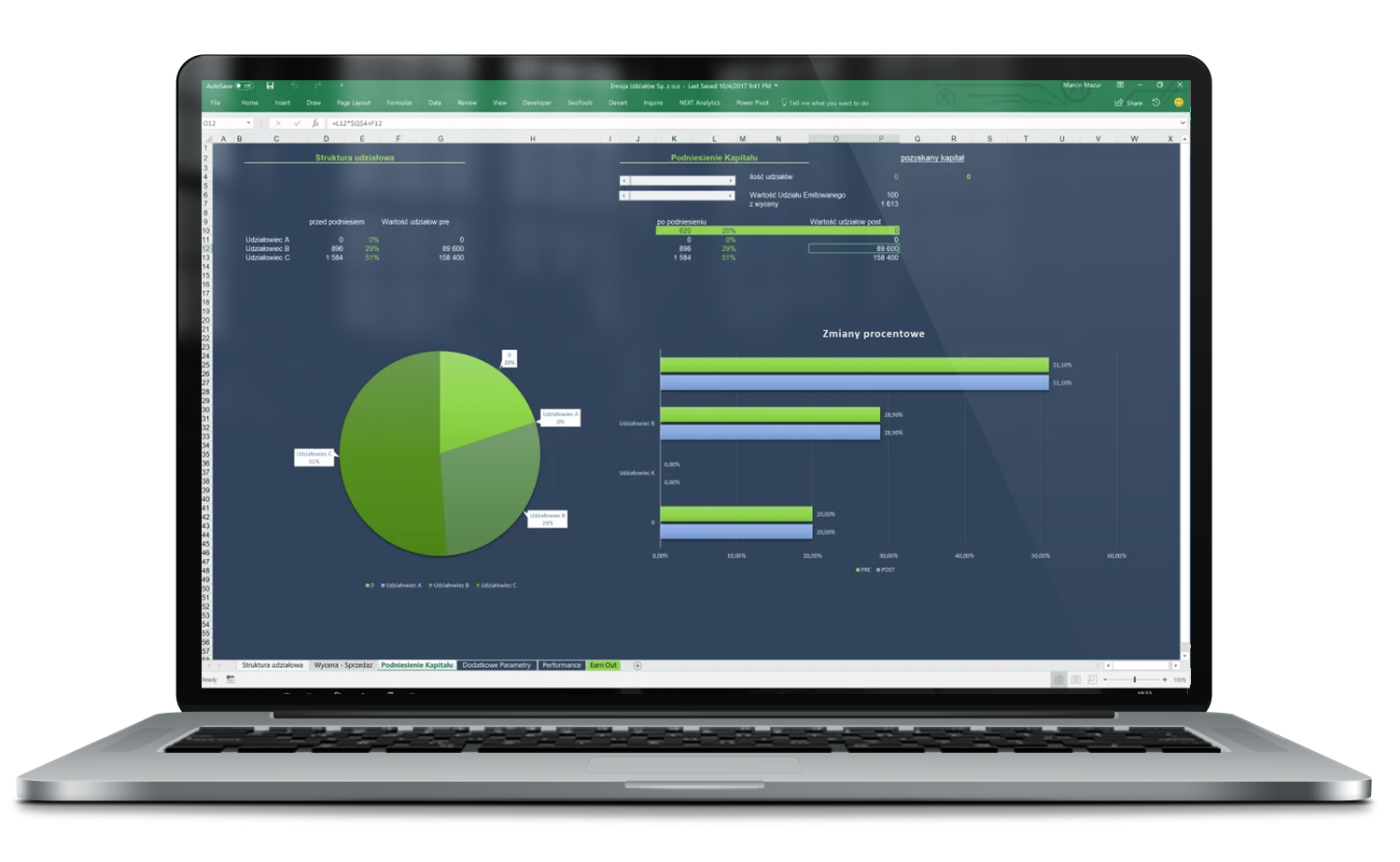

Capital increase by the investor

This shows the situation after the investor acquires shares under a new issue, i.e., capital increase, contributing cash to the company.

- A new issue of shares (e.g., 777 units) increases the total number of shares.

- The investor acquires these shares at the accepted valuation – new capital is raised (e.g., PLN 1,181,040).

- The other partners are diluted proportionally to the new issue (their percentage holdings decrease).

- The company gains new funds, which can be allocated for development, expansion, R&D, or hiring.

At this stage, the model allows you to:

- Analyze the dilution effect, but also the increase in share value.

- Calculate the raised capital, which drives the company’s further growth opportunities.

- Show the investor and partners how their positions will change – and under what conditions it makes sense.

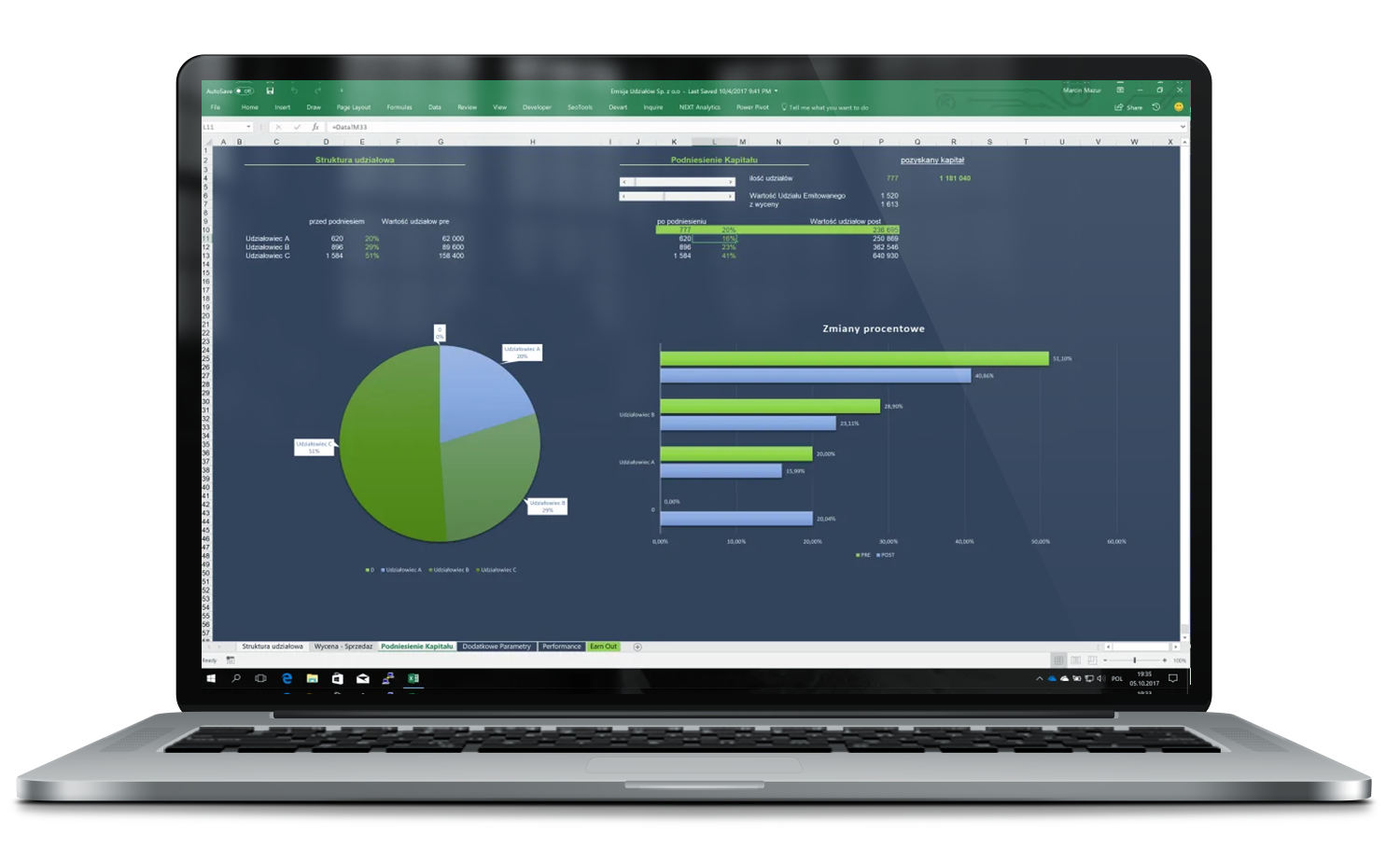

New pre-issue valuation – starting point for Earn Out

This screen shows the moment when the company reaches a valuation of PLN 30.8 million, but before the investor is granted additional shares under the Earn-Out.

At this stage:

- The share structure remains unchanged – both the investor and existing partners hold their shares as before.

- The partners’ share value is updated according to the new valuation.

- The tool makes it easy to compare share value before and after achieving the target.

This is the moment when shared success is measured – before the investor receives the reward in the form of new shares.

The second screen shows the final stage of the process – after issuing new shares to the investor, which serves as a reward for achieving the agreed target (Earn-Out).

What has changed:

- The investor receives additional shares without the need for an additional investment, as per the agreed arrangement.

- Existing partners are proportionally diluted, but the value of their shares continues to rise thanks to the PLN 30.8 million valuation.

- There is a clearly visible changed ownership structure, with an exact allocation of shares and value after the issue.

This is the stage where the actual division of the reward for the achieved result can be seen – transparent, fair, and beneficial for all sides.