Introduction to the Financial Model of a Joint Venture Project

The presented financial model was prepared for the purpose of negotiating the terms of cooperation in a joint venture format between two entities: a company providing clients through its own marketing channels (Entity A) and a company offering online financial services (Entity B).

The goal of the model was to create a transparent tool enabling:

- determining the value of resources contributed by each party,

- analyzing the profitability of cooperation for both parties,

- dynamically conducting negotiations based on numerical data,

- quick modification of model parameters and observing their impact on results.

Project Assumptions:

- promotion period,

- flat fee rate,

- profit share level and its duration.

Marketing Section

- Ability to enter parameters for 16 different marketing channels.

- Separate Rate Card and discount value for each channel.

Financial parameters of services (Entity B):

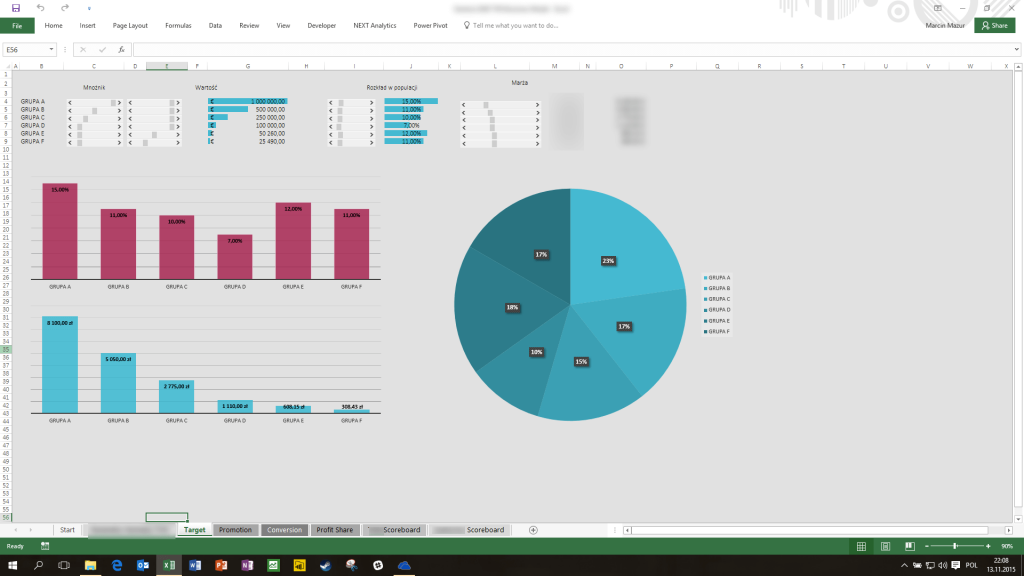

In this section of the financial model, Entity B provided data on the historical distribution of the service in the population, which enabled identification of the potential target and market shares in individual segments.

Additionally, estimates of achievable operating margins were presented, depending on each customer segment. This information was used in the model to analyze the profitability of cooperation and the potential financial outcomes of the project.

The model accounts for:

- The structure of population shares according to Entity B’s data,

- The range of possible operating margins depending on customer segment.

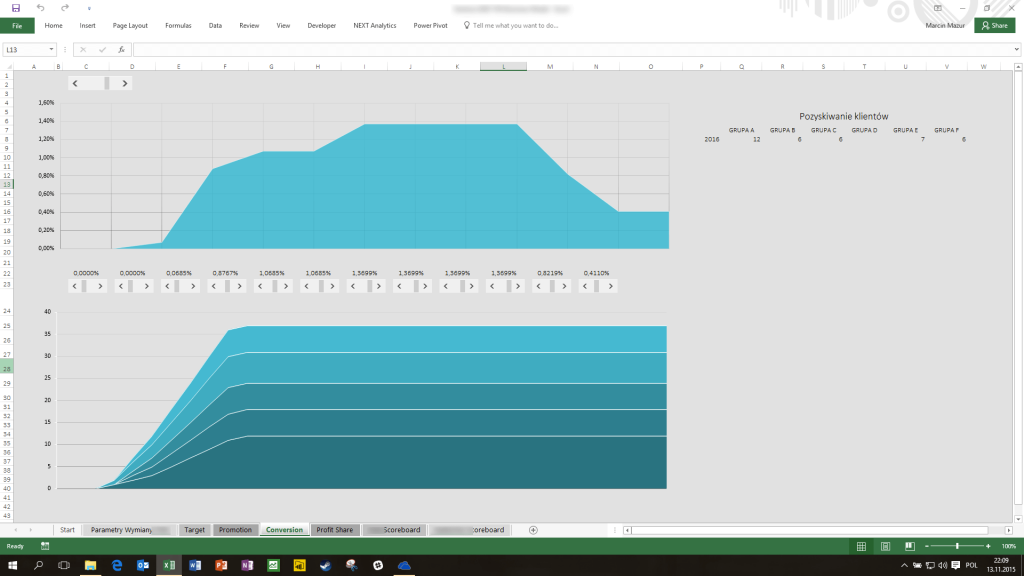

Conversion Parameters – Input Data (Entity A)

At this stage of the financial model, assumptions proposed by Entity A regarding the conversion of leads to end customers were used. These parameters were introduced as control variables that influence further business value forecasts.

Specifically, the model enables:

- Introducing assumptions about the effectiveness of sales activities – from leads to customers,

- Automatic recalculation of the number of acquired customers over time,

- Estimating the business value resulting from the increase in the customer base across different segments.

This is a key component of the model – it allows for evaluating the potential scale of the project depending on the adopted assumptions of operational effectiveness.

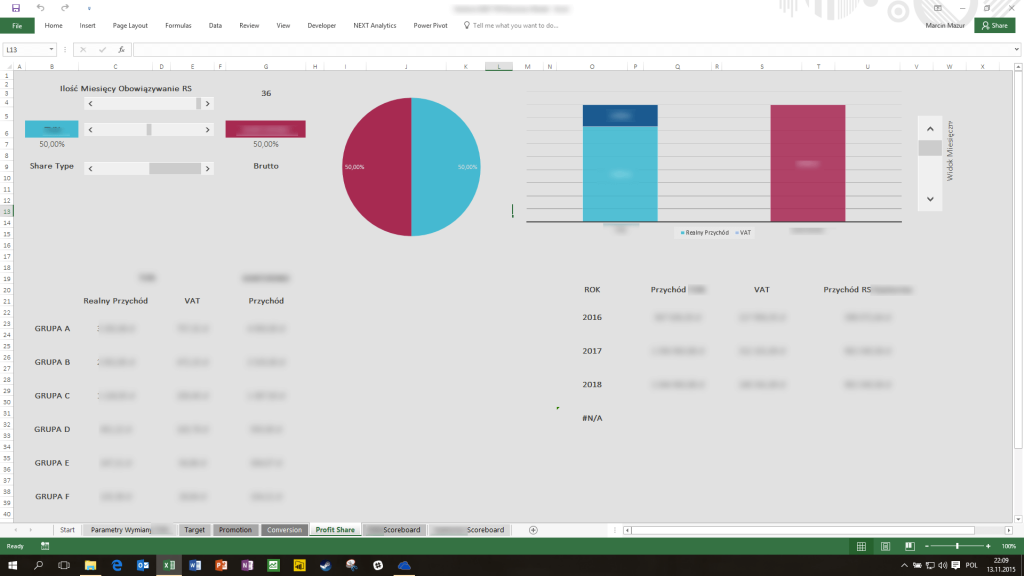

Negotiation Dashboard – a dynamic space for testing cooperation terms

This tool enables investment discussions to be conducted based on specific, measurable data. Within the dashboard, it is possible to:

- Interactively test different cooperation and value-sharing scenarios,

- Modify parameters such as contract duration, rate levels, operating margins, and net and gross values,

- Instantly analyze the impact of changes on financial performance – both on a global scale and broken down by target segments,

- Clear visualization – charts and tables allow for rapid identification of the most advantageous options for both parties.

This module played a key role in the negotiation process – it allowed the parties to move away from generalities and conduct talks based on hard data.

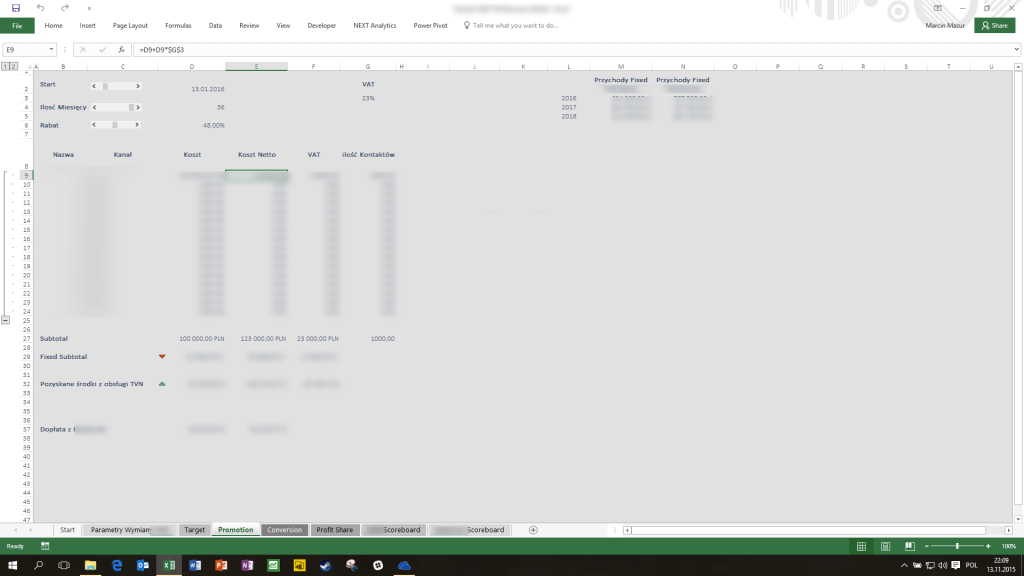

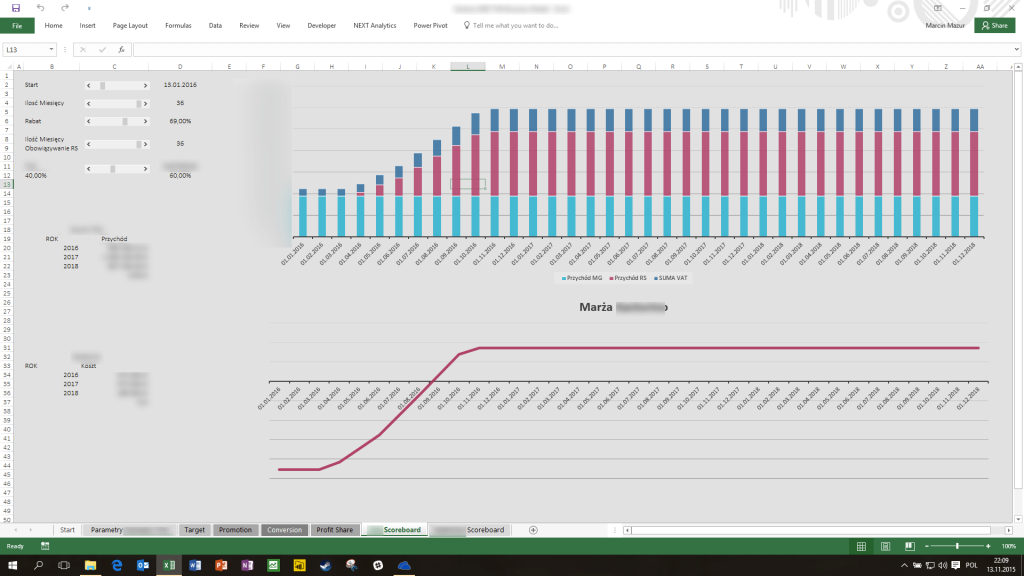

Analytical View (Entity A) as an advertising service provider

It was also possible to implement changes in the business model regarding:

- specifying the project launch date,

- specifying the duration of the profit share period,

- specifying the percentage discount value on the promotional channel,

- the percentage value of the profit share.

Aggregate revenues attainable by Entity A are also visible, with breakdowns by:

- marketing channels,

- VAT rate,

- and participation in the profit share.

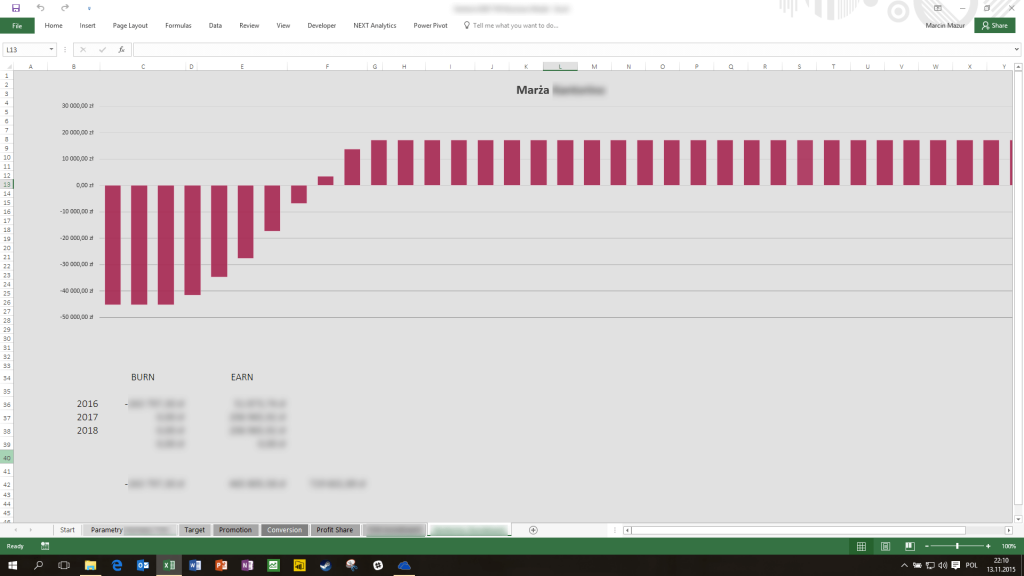

Analytical View (Entity B)

Each partner could analyze their share in the transaction – the model showed the share in net profits, assigned costs, and the margin level depending on customer group and acquisition channel.

Charts made it possible to quickly compare different offer variants.

The model was used for conducting professional business discussions and negotiations between partners.

Thanks to the model, each party could dynamically assess the impact of changing individual parameters on the profitability of cooperation and build win-win scenarios.

The model was designed in Excel using advanced mechanisms for dynamic recalculation and interactive parameter control.