Development of a financial model supporting the launch and growth of a VoD service within the operations of a cable network operator.

Project goal: Assessment of the profitability of investment in the VoD service

SCOPE OF THE FINANCIAL MODEL:

Revenues:

- Subscriptions (basic and premium packages)

- Pay-Per-View (one-time transactions)

- Advertising revenues (AVOD or hybrid models)

The model included the ability to separate financial results for the VoD segment from the operator’s existing business – enabling margin and investment return analysis specifically for the VoD service.

Cash burn levels and the moment when the service becomes profitable (break-even at a given ARPU and churn rate) were estimated.

Costs:

- Content (licenses, usage-based settlement)

- Technical costs (platform maintenance)

- Marketing and user acquisition

- Customer support, administration

Investments (CAPEX):

- Technology platform (OTT)

- Integration with existing systems

- Launch campaigns

BUSINESS SCENARIOS

The model was designed for comparing commercial offers from various content and technology providers.

It enables assessment of:

- the total cost of individual proposals,

- licensing terms (fixed fee vs revenue share),

- initial investments required (technology, integrations, launch campaigns).

Additionally, it supports decisions regarding:

- the structure of the offer (premium, bundled packages),

- the duration and flexibility of agreements with suppliers,

- the potential impact on EBITDA and cash flows.

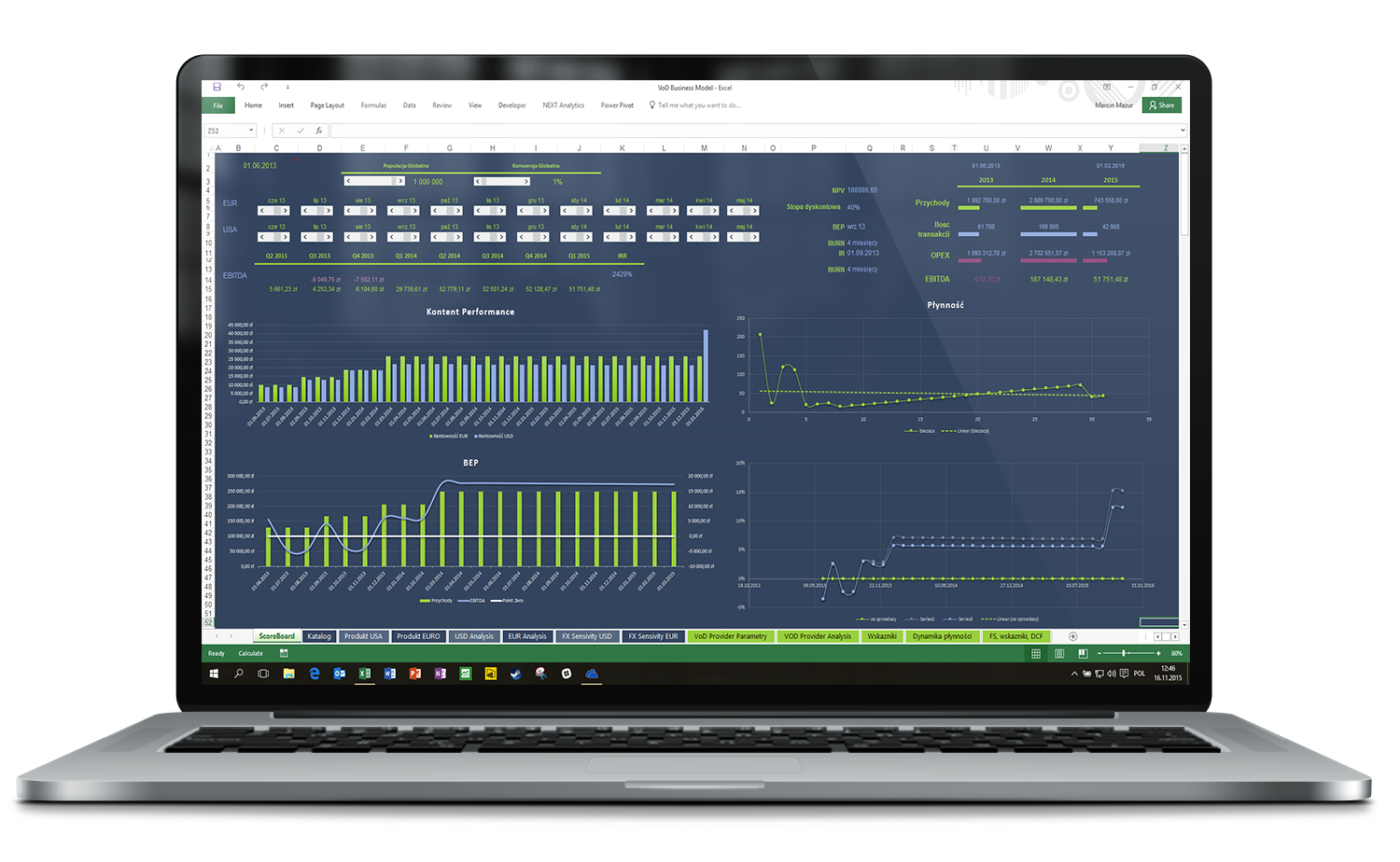

FINANCIAL MODEL – FINANCIAL DASHBOARD

The model enables assessment of:

- Content packages – various scopes from different aggregators

- Billing models – fixed fees / per user / revenue share

- OTT technology platform offers – differences in implementation costs, SLA, and user support

- Required marketing investments.

Each scenario is reflected in:

- revenue and cost forecasts

- investment schedule

- cash flow and financial ratio analysis (NPV, IRR)

PRICING STRATEGIES

The model allowed testing of various pricing strategies and VoD service growth paths:

Pricing strategies and ARPU:

- Different package price levels were defined (basic, premium, pay-per-view).

- The model enabled assessment of how changes in ARPU affect profitability and EBITDA levels.

Growth scenarios:

- Various scenarios were simulated:

- Each had its own assumptions regarding customer acquisition pace, retention, churn, and acquisition costs.

- It was possible to test the impact of marketing campaigns on user growth.

LTV/CAC and churn analysis:

- The long-term customer value (LTV) was calculated based on ARPU, customer lifetime, and servicing costs.

- This was compared to customer acquisition costs (CAC) under various marketing strategies.

- Dynamic recalculation of metrics over time was possible – e.g., after increasing churn by 5% or changing the marketing budget.

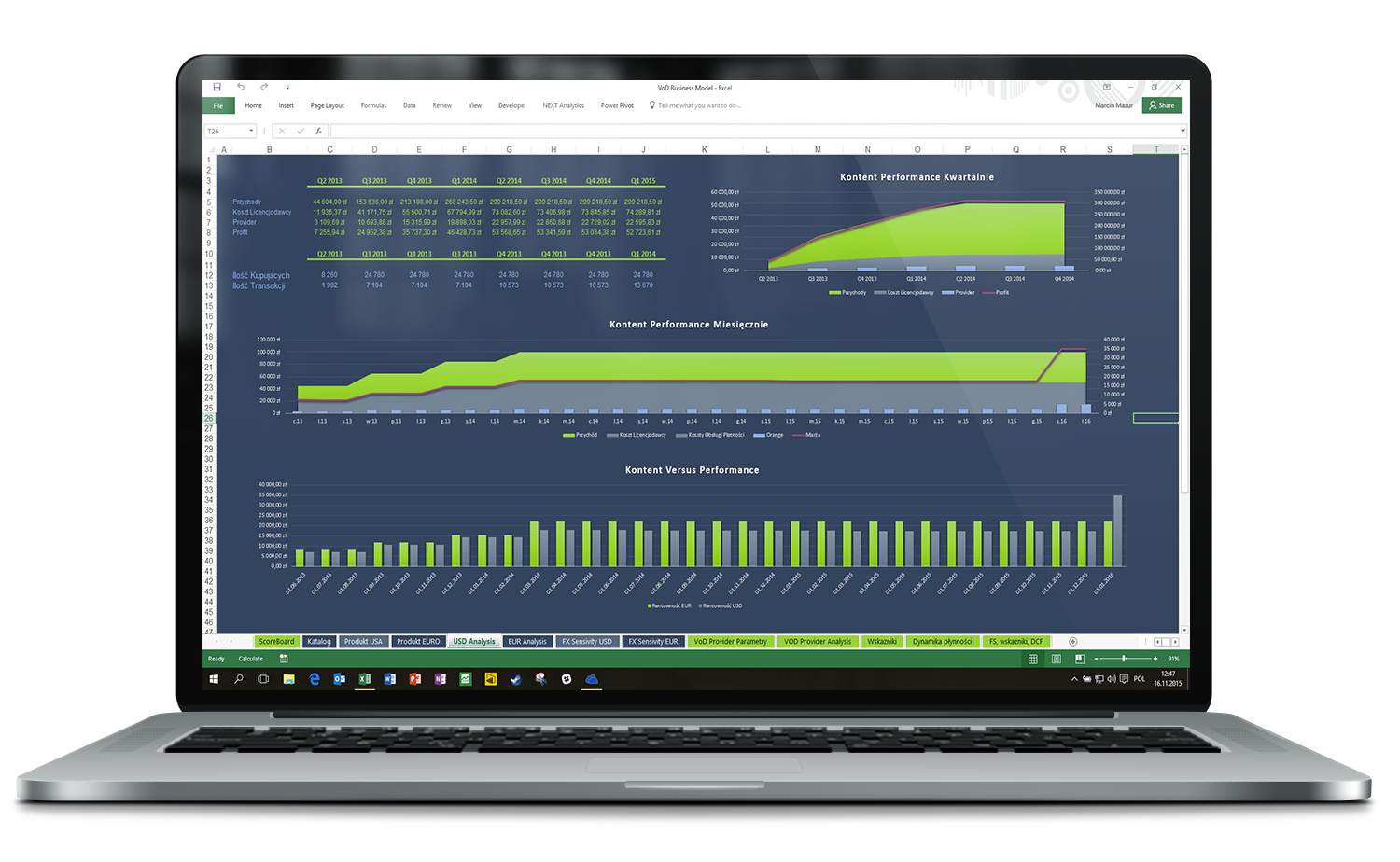

Cash flow modeling:

- Cash flow was generated on a monthly and quarterly basis.

- It was possible to analyze the impact of investment or campaign delays on liquidity.

- Schedules for payments for content, integrations, and delays in customer inflows were included.

The model enabled testing of various pricing strategies and VoD service development paths:

Pricing strategies and ARPU:

- Different package price levels were defined (basic, premium, pay-per-view).

- The model allowed assessment of how changes in ARPU impact profitability and EBITDA levels.

Growth scenarios:

Various scenarios were simulated:

- Each scenario had its own assumptions regarding customer acquisition rate, retention, churn, and acquisition costs.

- It was possible to test the impact of marketing campaigns on user growth.

FINANCIAL MODEL – FINANCIAL DASHBOARD

The financial model accounted for the fact that the main licensing and technology contracts were denominated in USD and EUR. A module was built in to simulate the impact of exchange rate changes on:

- the total costs of content providers,

- profitability and EBITDA levels.

It was possible to dynamically change exchange rates over time (taking into account forecasts or strategic assumptions).

The model user could test any scenario, including:

- stable exchange rate (long-term contract),

- appreciation of the zloty (cost reduction),

- depreciation of the zloty (risk of increased CAPEX and OPEX).

For each scenario, the model generated:

- an update of projected cash flows,

- changes in the project’s IRR and NPV,

- new break-even points for each analyzed provider.

PRACTICAL APPLICATION OF THE MODEL

Cash burn levels and the moment when the service becomes profitable (break-even at a given ARPU and churn rate) were estimated.

The model was used for:

- presenting the project to the management board and industry investors,

- comparing 3 alternative market entry strategies,

- developing negotiation arguments for content provider contracts,

- planning the investment financing path – using both equity and debt financing.