The financial model was created at the end of 2011 with the idea of an online currency exchange platform, operating under the following conditions:

- ultra-low margins,

- high operational risk,

- dependence on banking infrastructure,

- the necessity to build customer trust from scratch.

It provided a comprehensive analysis of profitability, risks, and capital requirements—serving as a foundation for investment and management decisions.

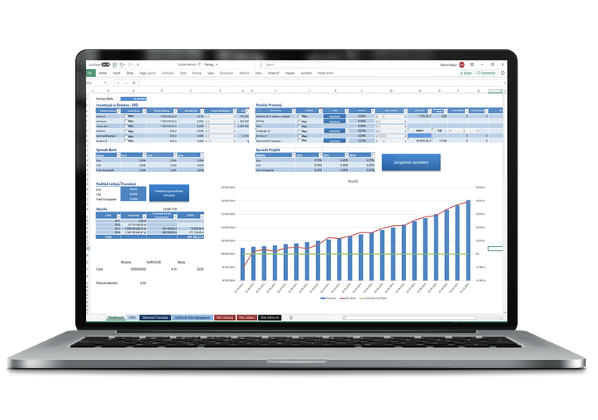

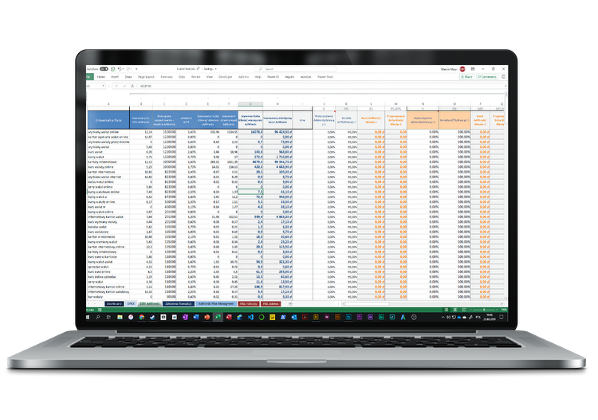

The main dashboard of the model served an informational and control function:

- it presented a consistent picture of the financial situation,

- enabled scenario analysis and risk assessment,

- supported the due diligence process and negotiations with the investment fund,

It was a practical tool for communication between the project team and the investor.

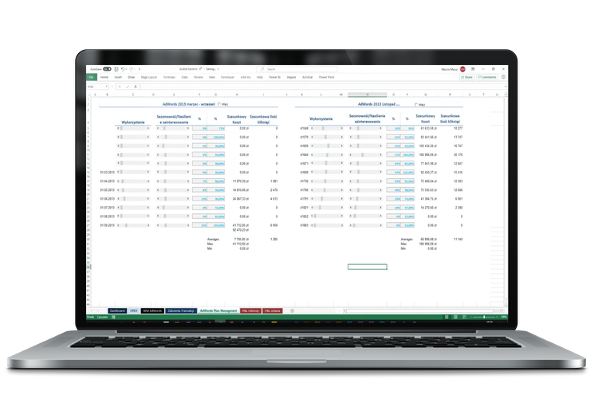

The financial model enabled dynamic planning of advertising campaigns based on Google Ads data.

The user could:

- test different budget scenarios,

- evaluate campaign effectiveness in terms of customer acquisition cost (CAC),

- analyze the impact of marketing activities on revenue and cash flow.

The solution provided high transparency and flexibility in the area of promotion.

The financial model enabled precise estimation of variable costs associated with acquiring customers online.

Data from Google Ads (at the keyword level) was used, allowing for:

- determining the cost of acquiring a single customer (CAC),

- comparing campaign effectiveness across target groups,

- optimizing promotional activities in real time.

This was crucial for a model based on low margins and high competition.

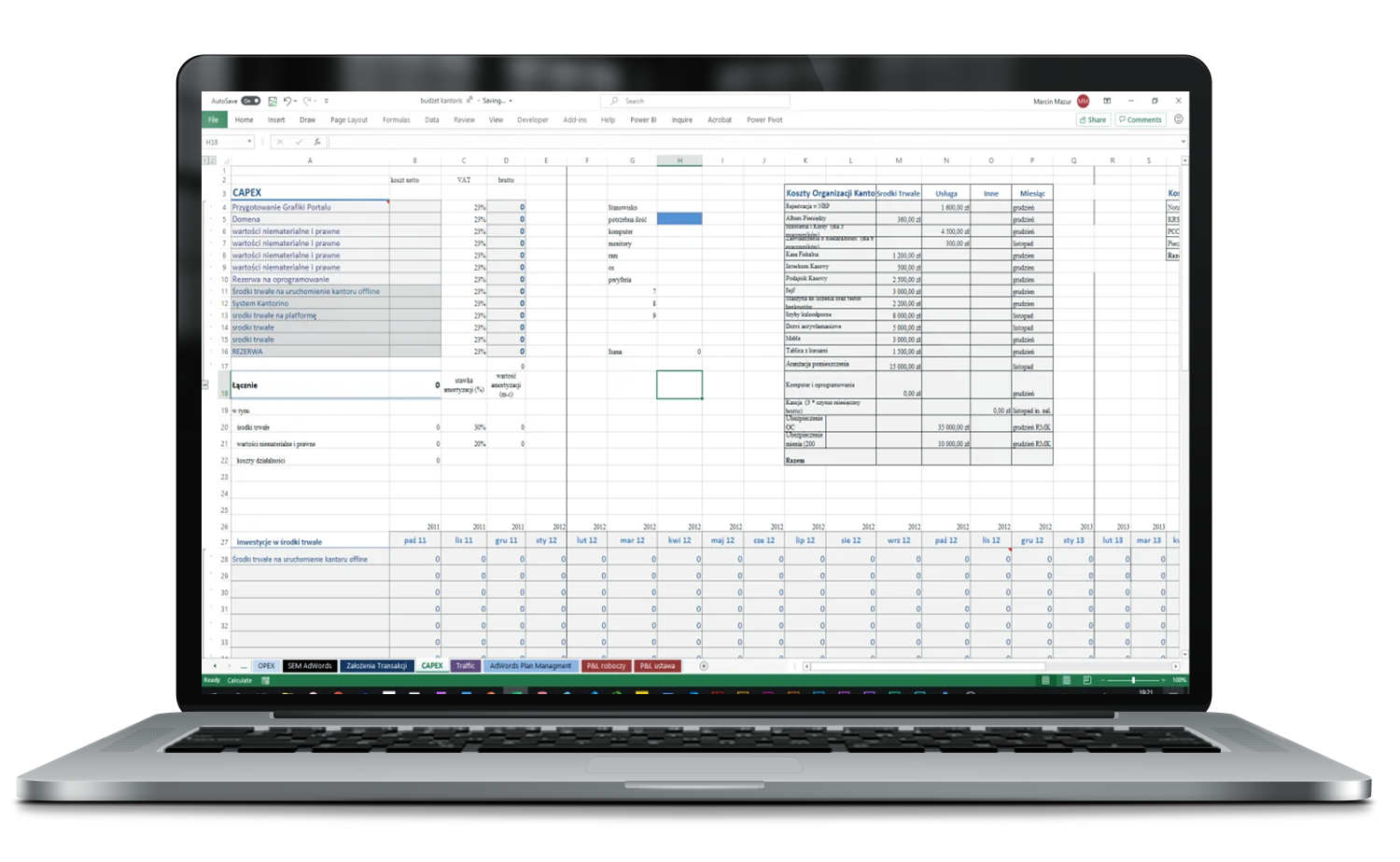

The financial model offered a complete breakdown of investment costs (CAPEX) and operating costs (OPEX), making it easier to:

- realistically plan capital requirements,

- precisely allocate costs to development stages,

- identify fixed and variable costs depending on volumes.

As a result, the model’s recipient gained a tool that supported both budgeting and financial analysis.

The financial model supported the project from the idea stage through to full implementation and operational launch of the platform.

- over one billion PLN in revenue in the second year,

- a positive net result,

- complete control over the achievement of financial objectives.

The model was developed and used operationally for over 7 years—from the investment stage, through growth, to ongoing reporting and financial management.