It started with a question: how to build an online currency exchange that can survive in conditions of ultra-low margins?

It ended with a comprehensive fintech management system – from a financial model, through a BI system and invoice automation, to sales tools.

The startup began its operations in one of the most demanding segments of the financial market – online currency exchange.

The success of the project was an answer to the market challenges: ultra-low margins, high bank competition, the need to build trust from scratch, and the requirement for rapid scaling while maintaining full cost control.

The build-out covered full operational and financial integration:

-

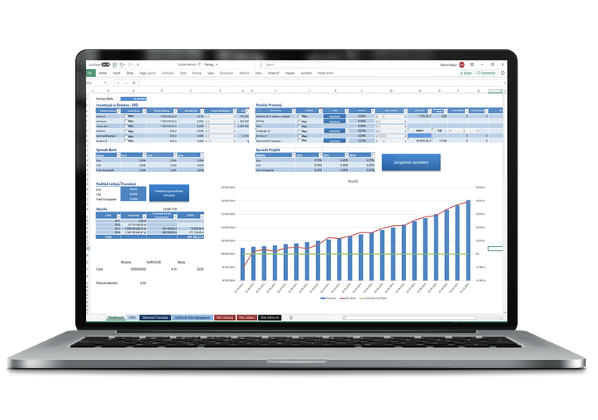

designing the financial model supporting investment decisions,

-

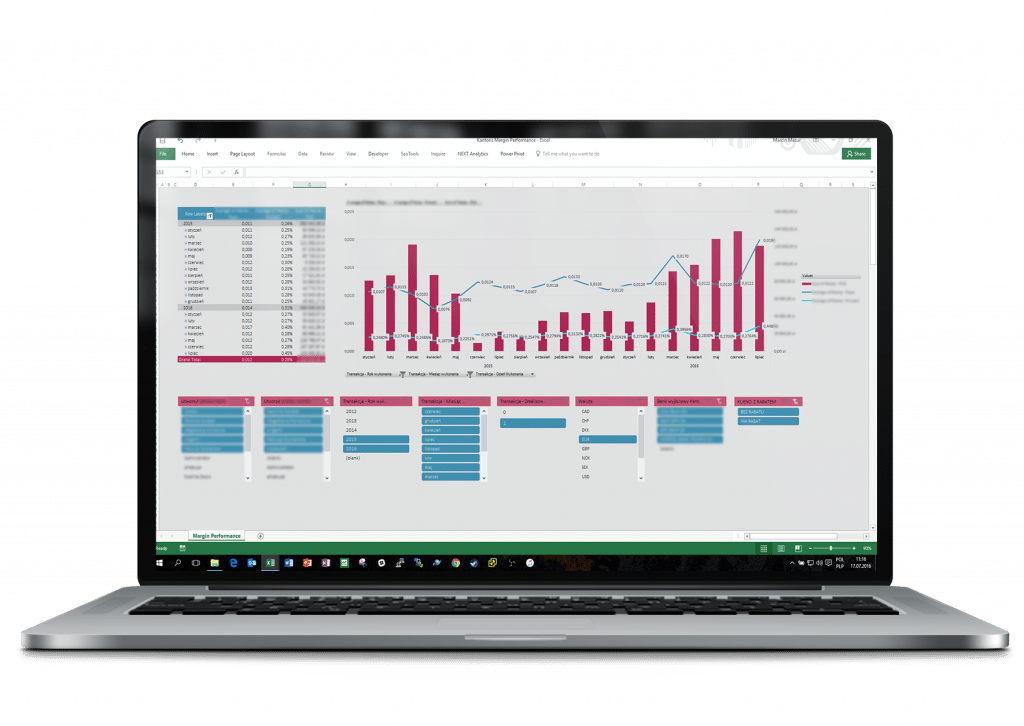

implementing a BI system for managing currency transactions,

-

automating accounting processes,

-

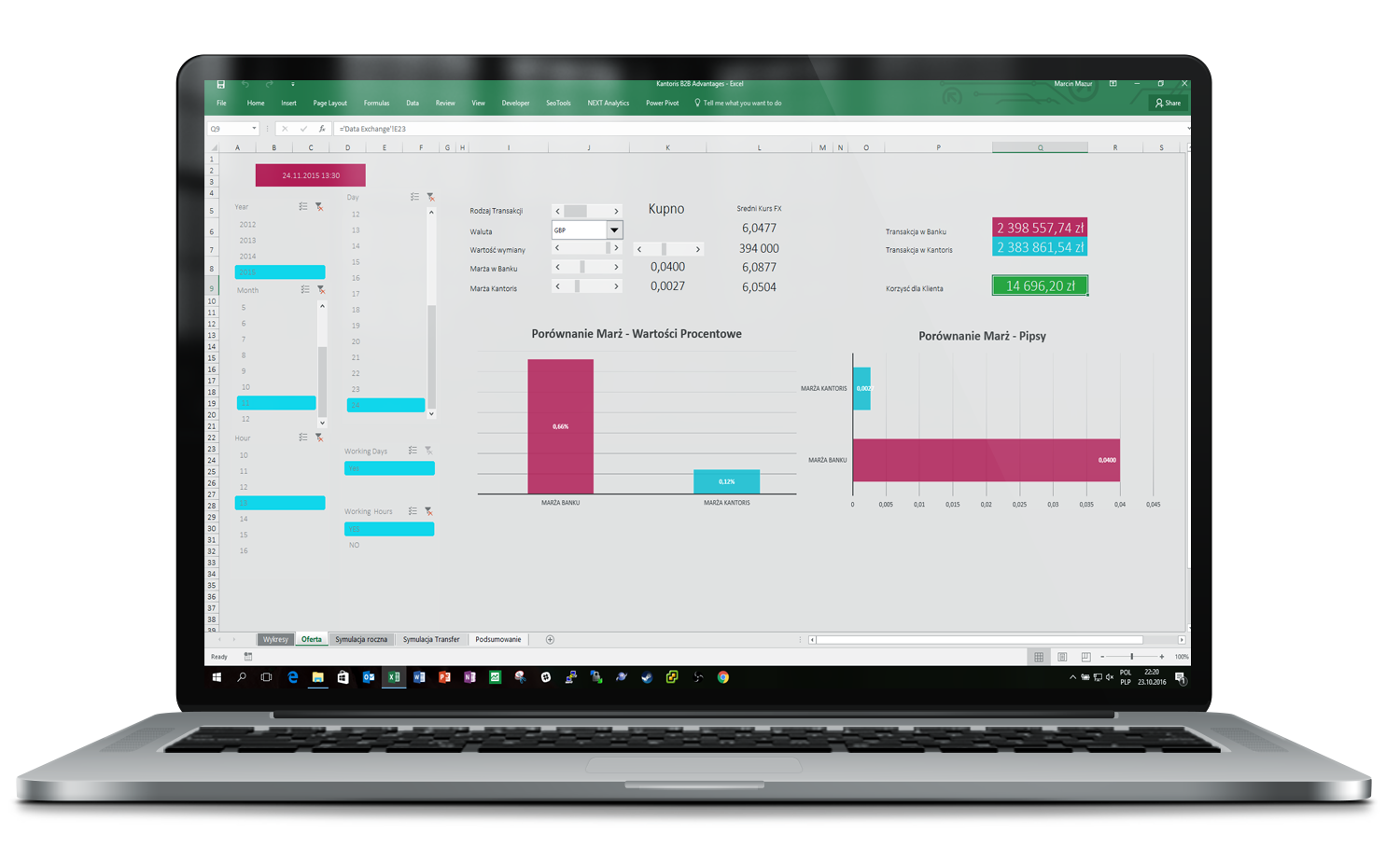

creating data-driven sales tools.