Project details

Financial modeling included:

- Promotion Period,

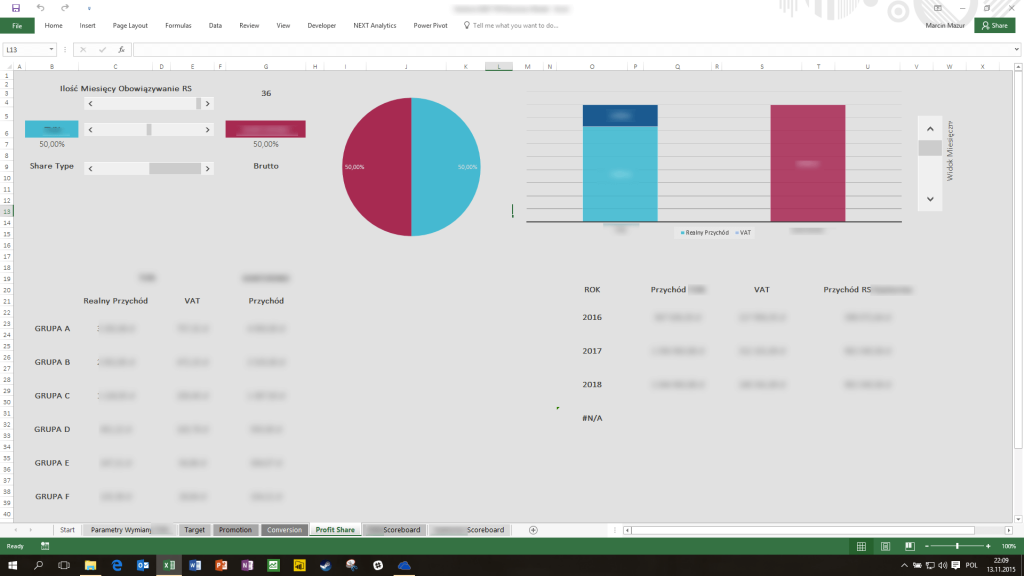

- Profit Share value,

- Flat fee rate

- Profit Share Period.

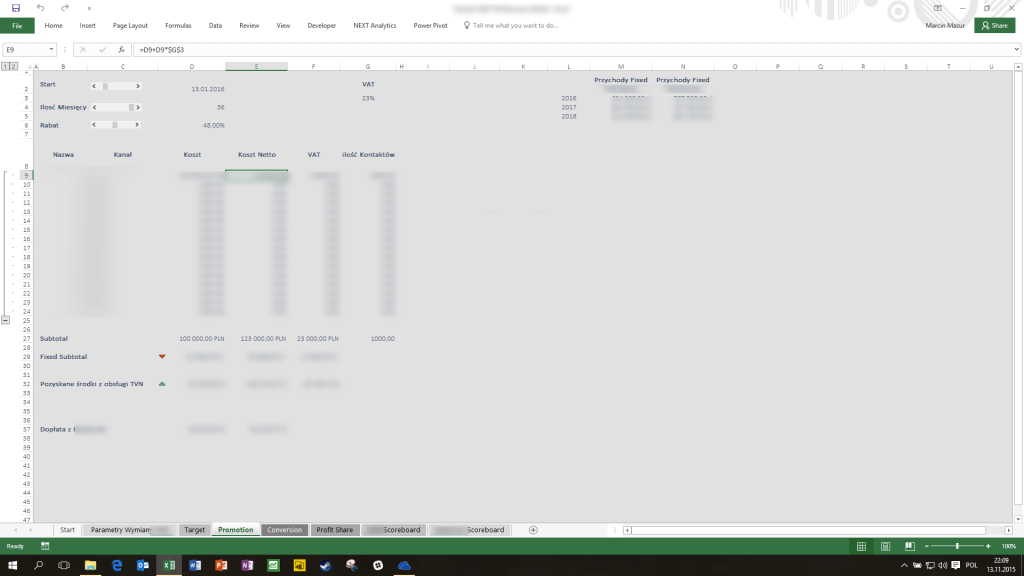

Basic data of the joint venture financial model

In this section of the financial model, it was possible to enter declarative data on marketing parameters, detailing 16 dedicated marketing channels with their current Rate Card price and the rebate rate, the maximum value of which may be 100%.

This was necessary because the promotion was to take place in several different media and each channel was set individually.

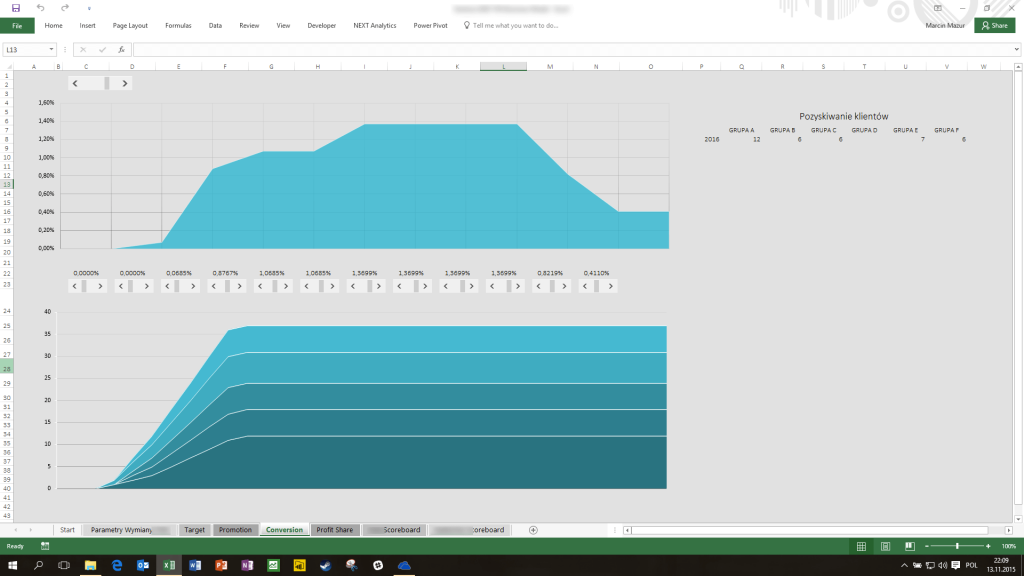

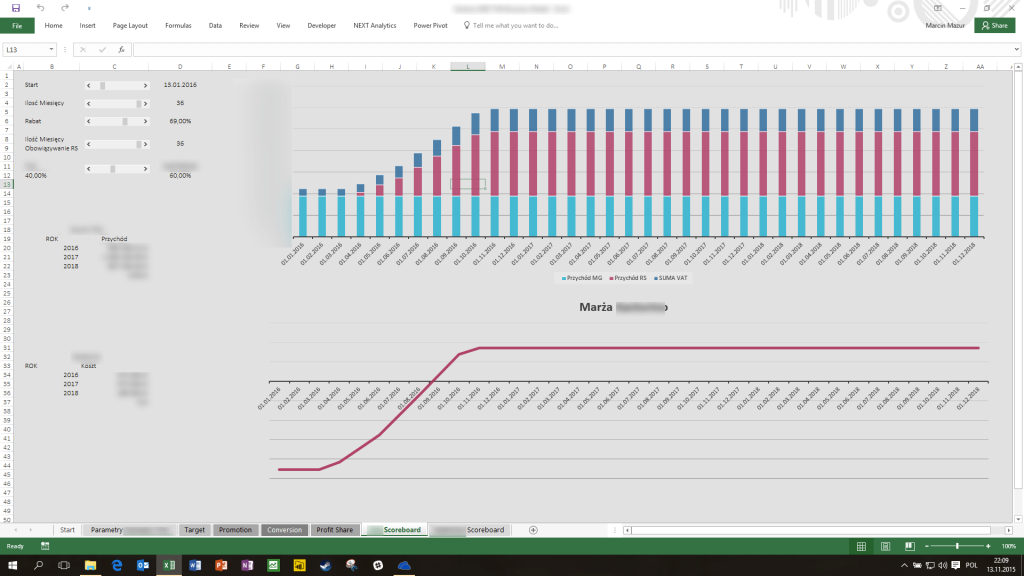

In this part of the model, quick changes to the form parameters are available, specifying:

- number of months of the profit share period,

- profit share rates,

- distinction Gross / Net (due to the fact that advertising rates are taxed at 23% VAT and financial services at 0% VAT.

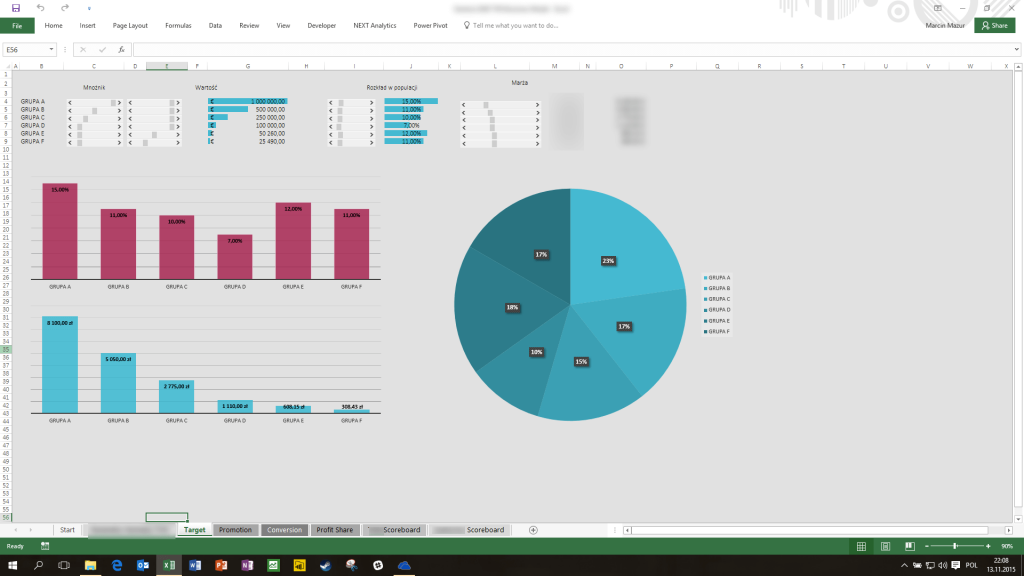

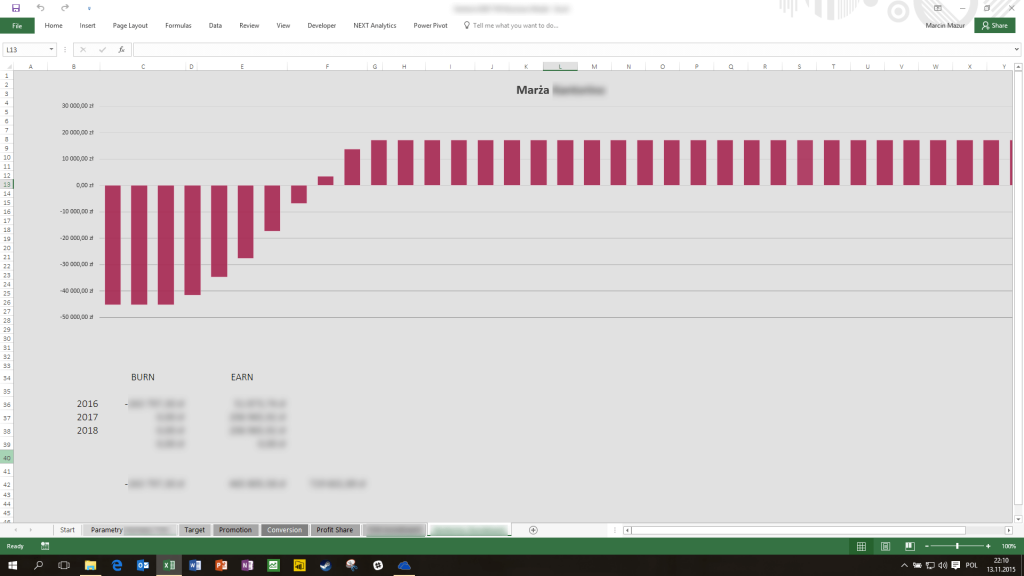

There is also a simple efficiency analysis achieved in individual target groups, measured in the form of the achieved margin.

Analytical view for company A, provider of advertising services

It was also possible to make changes to the business model in terms of:

- to specify the project start date

- determining the duration of profit share,

- determine the percentage of the discount on the promotional channel,

- profit share percentage.

There are also shown total revenues that can be obtained by entity A with the following specification:

- marketing channels,

- VAT rate,

- and participating in profit share.

Polski

Polski