Project details

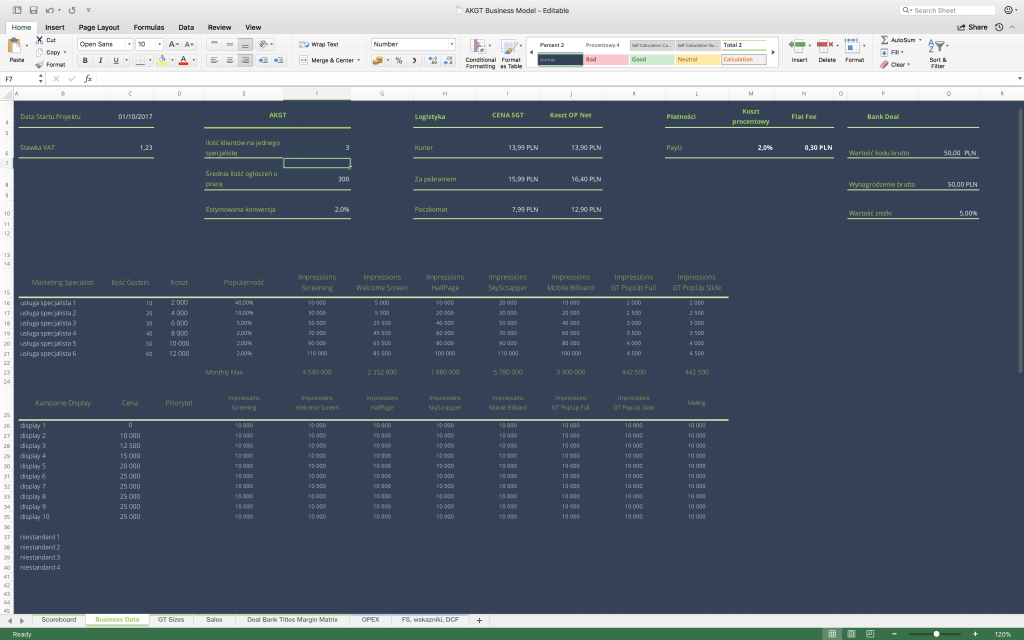

The project assumed the preparation of professional financial forecasts to be one of the negotiating tools for a joint venture project. One of the entities was to provide clients to the other company using marketing channels. The second company provided financial services via the Internet.

Financial forecasts, along with the possibility of business modeling, made it possible to speed up the negotiation process as each party could assess the value of their contribution against the achievement of potential benefits.

Financial modeling included, inter alia:

- Promotion Period,

- Profit Share value,

- Flat fee rate

- Profit Share Period.

Basic data of the joint venture financial model

In this section of the financial model, it was possible to enter declarative data on marketing parameters, detailing 16 dedicated marketing channels with their current Rate Card price and the rebate rate, the maximum value of which may be 100%.

This was necessary because the promotion was to take place in several different media and each channel was set individually.

Polski

Polski